How To Create A Business Budget

Apr 29, 2025

Understanding the numbers in your business is crucial as it gives you the ability to make informed business decisions such as where to cut costs, where to invest more money and more importantly to make sure you’re on track to reach your business goals.

Ever since the day we started Cosy Aromas we introduced a budget spreadsheet where we set out our sales and expenditure targets for the year.

It’s very difficult to stay on budget in your first year because you have no trading history and quite frankly you have no idea how things are going to go.

However, in year 2 and onwards, when you do have previous trading numbers to go off it makes it much easier to create and stick to an annual budget.

What is a Business Budget?

It's simply creating a financial plan for the upcoming year based on your past income and expenses. This plan helps you determine how much you can spend and what revenue you need to generate.

Budgeting is an essential part of the planning process as it helps you set goals, implement activities, and manage your expenses effectively. By creating a budget, you gain a clear understanding of how your business is performing.

Why Do We Need Business Budgets?

A well-crafted budget serves as your financial roadmap, guiding your business towards its goals. It enables you to plan, monitor, and make informed decisions about your income and expenses. With a budget in place, you gain control over your finances and set the stage for long-term growth.

What Should Your Business Budget Include?

To create an effective budget, you need to consider various factors. Here are some key elements to include:

- Revenue Goals: Determine your target income and set realistic expectations for sales and revenue generation.

- Expense Allocation: Identify and categorise your expenses into fixed costs (such as rent, salaries, utilities, and insurance) and variable costs (like inventory, selling fees etc).

- Profit Margins: Evaluate your gross and net profit margins to understand how efficiently your business is generating profits and managing costs.

- Cash Flow Analysis: Monitor your cash flow to ensure you have sufficient funds to cover expenses.

- Contingency Planning: Account for unexpected expenses and set aside funds for emergencies or unforeseen circumstances.

How to Make the Most of Your Business Budget?

A budget is only effective when put into action. Here are some tips to help you maximise its benefits:

- Set Realistic Goals: Align your revenue and expense targets with your business objectives. Strive for ambition, but remain grounded in what is achievable.

- Monitor and Adjust: Regularly review your budget and compare it with actual performance. Identify any discrepancies and make necessary adjustments to stay on track.

- Use Budgeting Tools: Leverage technology and software solutions that simplify budget management and provide real-time insights into your financials.

Remember, a business budget is not set in stone. It's a dynamic tool that allows you to adapt and refine your financial strategies as circumstances change. By embracing budgeting as a fundamental practice, you'll gain clarity, make informed decisions, and propel your business towards greater success.

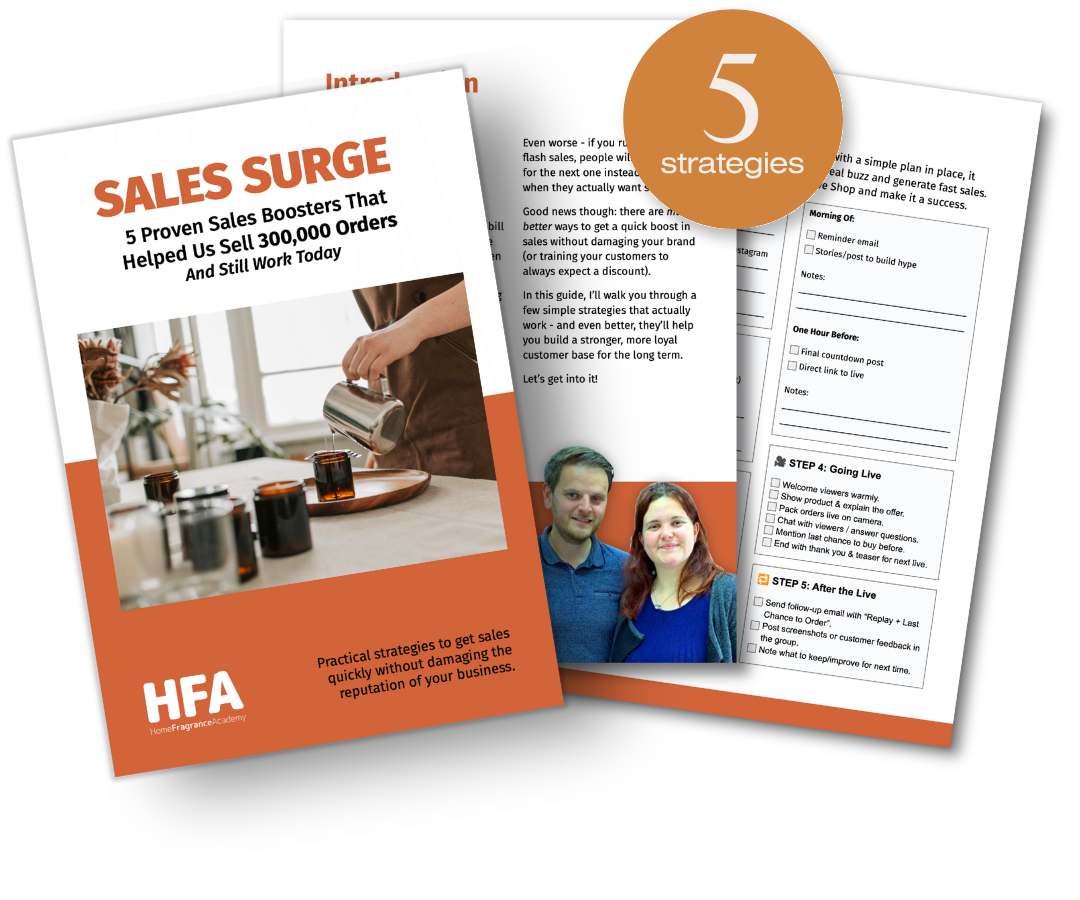

Download my Business Budget Template

I've create a demo business budget spreadsheet for you. Simply click here to access, then click on 'File' and 'Make a copy'. Save it to your Google Drive and edit as you need.

It's quite intuitive, but if you have any questions or need any help with it, please let me know.

Have a great day,

Paul

P.S. I've recently released a new YouTube video, I'd love it if you would subscribe to our channel as we'll be creating videos full of advice each week.